Building a new property from the ground up is an exciting opportunity for real estate investors. Whether you’re constructing a rental property, multifamily unit, or commercial space, securing the right financing is crucial to bringing your project to life.

Traditional lenders often make new construction loans difficult to obtain, especially for investors who don’t have W-2 income or conventional financial documentation. That’s where EDSCR (Economic Debt Service Coverage Ratio) financing comes in—offering a flexible, investor-friendly approach to funding new construction projects.

If you’re looking to get approved for a new construction loan without the usual income verification headaches, read on to learn how EDSCR-based loans can help you finance your next big project.

What Is an EDSCR Loan and How Does It Work?

EDSCR (Economic Debt Service Coverage Ratio) financing is a lending model that allows investors to qualify for loans based on the future rental income of a property, rather than their personal income or W-2 earnings.

Unlike traditional loans that rely on tax returns and personal financial history, EDSCR loans focus solely on the expected cash flow of the investment property.

How EDSCR Is Calculated

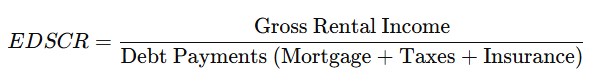

Lenders use the Debt Service Coverage Ratio (DSCR) to determine whether the property’s projected income can cover the loan’s payments:

✔ A ratio above 1.0 means the rental income will fully cover the loan obligations.

✔ A ratio of 1.25 or higher is preferred for better loan terms.

✔ A ratio below 1.0 may require a higher down payment or stronger reserves.

Since EDSCR financing is cash-flow focused, it’s an excellent option for new construction investors who plan to rent out their properties after completion.

Why Use EDSCR Financing for New Construction Loans?

Many real estate investors struggle to get approved for traditional new construction loans because banks require:

❌ W-2 income and tax returns (which self-employed investors may not have).

❌ Personal debt-to-income (DTI) calculations (which can limit loan amounts).

❌ Proof of rental income history (which isn’t possible for new builds).

With EDSCR-based loans, lenders prioritize the future cash flow of the property, making it easier to secure funding even before the building is complete.

✅ The Key Benefits of EDSCR for New Construction Loans

✔ No Personal Income Verification Needed – Your tax returns and W-2s aren’t required to qualify.

✔ Approval Based on Projected Rental Income – Even if the property isn’t built yet, lenders use expected cash flow to determine eligibility.

✔ Easier Approval for Investors – Great for self-employed individuals, rental investors, and entrepreneurs.

✔ Scalability – Since EDSCR loans don’t rely on personal income, investors can build multiple properties at once.

Bottom Line: If your new construction project is expected to generate strong rental income, an EDSCR loan can help you secure financing faster and with fewer restrictions.

How to Secure a New Construction Loan with EDSCR Financing

Now that you know why EDSCR loans are a game-changer, let’s go over the step-by-step process to get approved for new construction financing.

Step 1: Find an EDSCR-Friendly Lender

Not all lenders offer EDSCR-based financing, so start by finding a lender that specializes in investor loans and new construction financing.

✔ Look for lenders who focus on rental property cash flow, not personal income.

✔ Compare interest rates, loan terms, and down payment requirements.

✔ Ask about their minimum EDSCR ratio requirements (some require 1.0, others prefer 1.25+).

Pro Tip: Work with a mortgage broker who specializes in EDSCR loans to find the best lender for your project.

Step 2: Present a Strong Project Plan

Since your property isn’t generating income yet, lenders will want to see a clear plan for rental income potential.

✔ Construction Plans & Timeline – Provide blueprints, estimated completion dates, and cost breakdowns.

✔ Market Rent Analysis – Show projected rental income based on comparable properties in the area.

✔ Tenant Demand – Highlight why this location is attractive for renters (e.g., strong job market, low vacancy rates).

Pro Tip: A well-researched rental income projection can help you negotiate better loan terms.

Step 3: Prepare a Strong Down Payment

Most EDSCR new construction loans require a 20-30% down payment to secure financing. The exact amount depends on:

✔ Your projected EDSCR ratio (a higher ratio may lower the down payment requirement).

✔ Your credit score (higher scores may qualify for lower down payments).

✔ The lender’s risk assessment of the project.

Pro Tip: If you don’t have enough for a large down payment, consider partnering with investors or using equity from other properties.

Step 4: Demonstrate Financial Stability

While EDSCR loans don’t require personal income verification, lenders still want to ensure you have reserves to cover potential delays or shortfalls.

✔ Cash Reserves – Most lenders require 6-12 months of mortgage payments in reserves.

✔ Credit Score – A credit score of 680+ improves your loan terms.

✔ Experience – If you have prior real estate experience, mention it to strengthen your application.

Pro Tip: Having strong reserves can help you negotiate lower interest rates and better loan terms.

Step 5: Close the Loan & Begin Construction

Once your loan is approved, funds are typically released in stages as construction progresses.

✔ Draw Schedule – Your lender will release funds in phases (e.g., foundation, framing, plumbing, finishing).

✔ Inspections – Lenders require periodic inspections to ensure progress aligns with the plan.

✔ Final Approval – Once the project is complete, the lender will approve final funding.

After construction, you can:

✔ Rent out the property and begin generating income.

✔ Refinance into a long-term loan using the new rental income to qualify.

Final Thoughts: Is an EDSCR Loan Right for Your New Construction Project?

If you’re building a rental property and need financing that doesn’t require W-2s or tax returns, an EDSCR-based new construction loan is an excellent option.

Why EDSCR Loans Work for New Construction:

✅ No personal income verification required

✅ Approval based on rental projections

✅ Flexible terms for investors & self-employed borrowers

✅ Scalability—easier to finance multiple projects

If you’re an investor looking to build and expand your real estate portfolio, EDSCR loans offer a smarter, more flexible way to secure new construction financing.

Ready to fund your next project? Start exploring EDSCR loan options today! 🚀